operating cash flow ratio adalah

The operating cash flow ratio OCF ratio formula can be written as. Operating Cash Flow Net Income Non-Cash Expenses Increase in Working Capital Formula long form.

Operating Cash Flow Formula Calculation With Examples

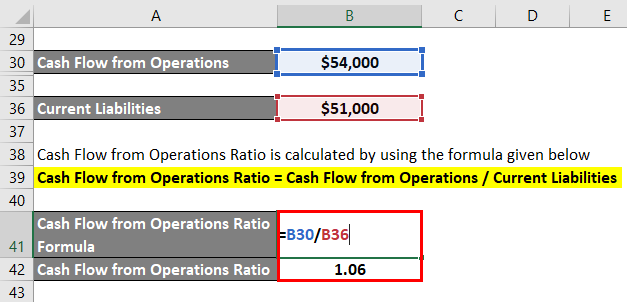

OCF Ratio Cash flow from core operations Current liabilities.

. Cash Flow-to-Debt Ratio. Cash Flow From Operating Activities 2100000 110000 130000 55000 1300000 - 1000000 2695000 To arrive at the operating cash flow margin. Rumus yang bisa digunakan untuk menghitung cash ratio adalah cash ratio kas setara kas hutang lancar.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. The cash flow to sales ratio is calculated by taking a companys total operating cash flow and dividing it by the net sales.

Operating Cash Flow Net Income Depreciation Stock Based. It is calculated by dividing its operating cash flow by its net sales. Arus kas dari operasi kewajiban operating cash flow ratio.

Definisi Arus Kas dari Operasi Cash Flow from Operating Acivities. Operating Cash Flow Ratio Arus Kas Dari Operasi Kewajiban Lancar. Berikut adalah rumus untuk menghitung operating cash flow ratio.

How can we calculate the Operating Cash to Debt Ratio. Rumus OCFR adalah. Rasio kas cash ratio adalah rasio keuangan untuk mengukur kemampuan perusahaan untuk memenuhi kewajiban jangka pendeknya.

Laporan arus kas adalah komponen dari laporan keuangan yang memuat informasi mengenai aliran keluar masuknya kas dan setara kas. Dengan formula di atas kita akan mendapatkan hasil Cash Flow per Share GJTL adalah. Apa itu Laporan Cash Flow.

Bagaimana Cara Menghitung Rasio Arus Kas. Dalam hal ini kas adalah seluruh alat pembayaran yang bisa. Arus Kas dari Operasi berasal dari Laporan Arus Kas dan Kewajiban Lancar.

Dalam hal ini kas adalah seluruh alat pembayaran yang bisa. It is expressed as a percentage. The formula for calculating the Cash Flow to Sales.

Operating Cash Flow Jumlah Saham Beredar. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. This ratio is a type of coverage ratio and can be.

The operating cash flow ratio is a useful indicator of a companys short-term liquidity because earnings include accruals and can be manipulated by management. Arus kas dari operasi atau Cash flow from operating activities merupakan bagian dari arus kas perusahaan yang mewakili. Rp 7388 miliar 3485 miliar Rp.

Operating cash flow ratio is generally calculated using the following formula. The components of OCF ratio are the cost of goods sold. Ini adalah rasio yang paling.

:max_bytes(150000):strip_icc()/TermDefinitions_CFF_finalv1-f2cdc1f2ec574548a8ccf94dd8cb7cfc.png)

Cash Flow From Financing Activities Cff Formula Calculations

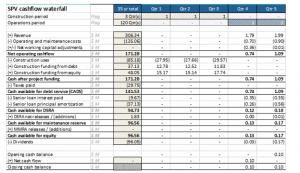

Project Finance Cash Flow Waterfall

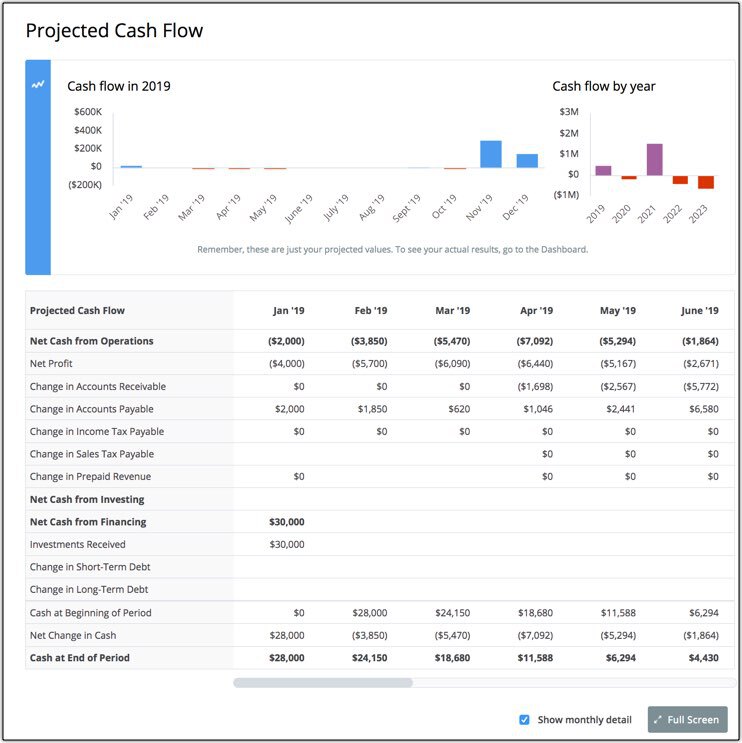

How To Forecast Cash Flow Bplans

Full Article The Influence Of Free Cash Flow And Operating Cash Flow On Earnings Management At Manufacturing Firms Listed In The Indonesian Stock Exchange

Cash Flows Balances And Buffer Days Jpmorgan Chase Institute

Net Cash Flow An Overview Sciencedirect Topics

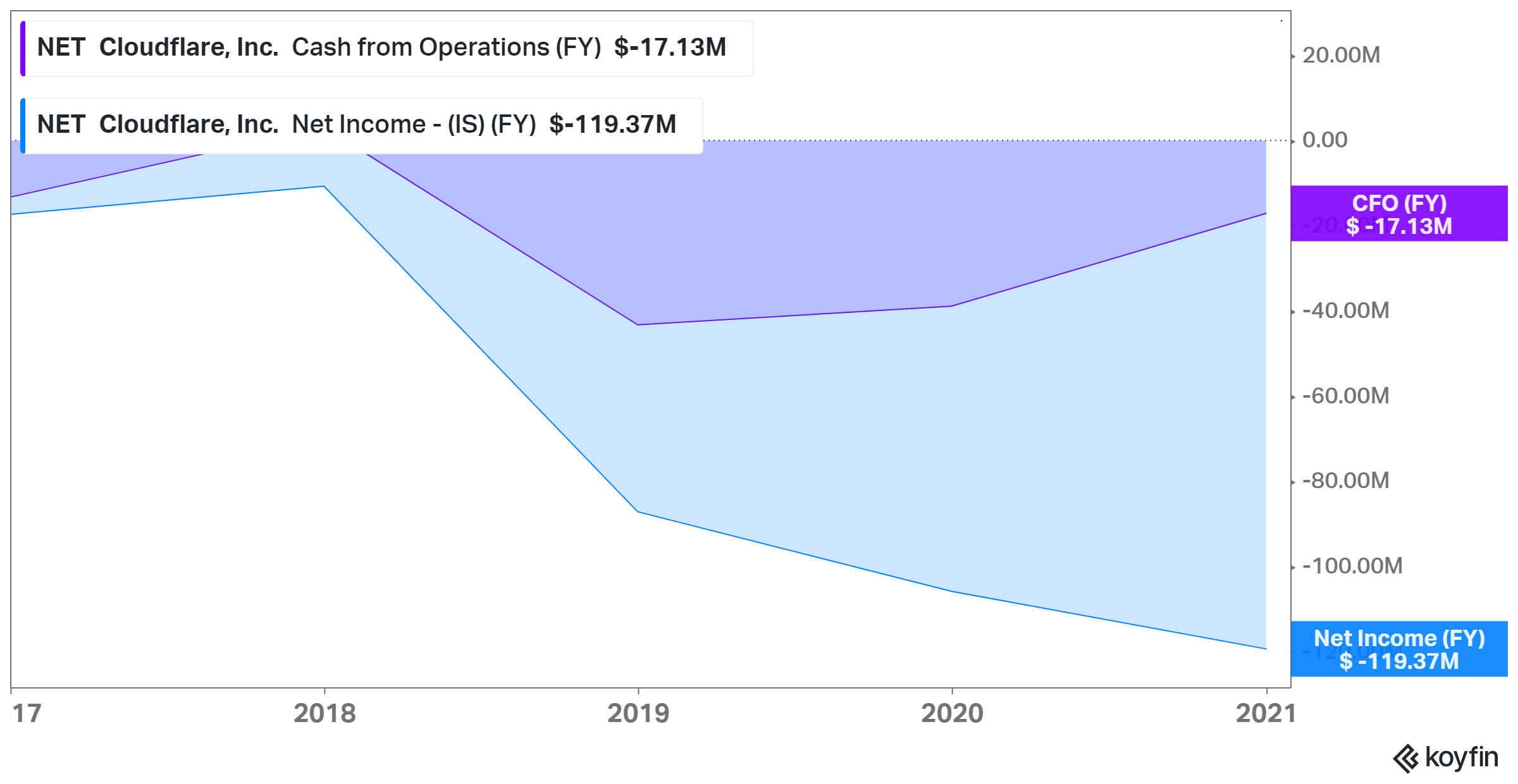

What Does A Negative Operating Cash Flow Mean Cliffcore

Cfads Cash Flow Available For Debt Service Mazars Financial Modelling

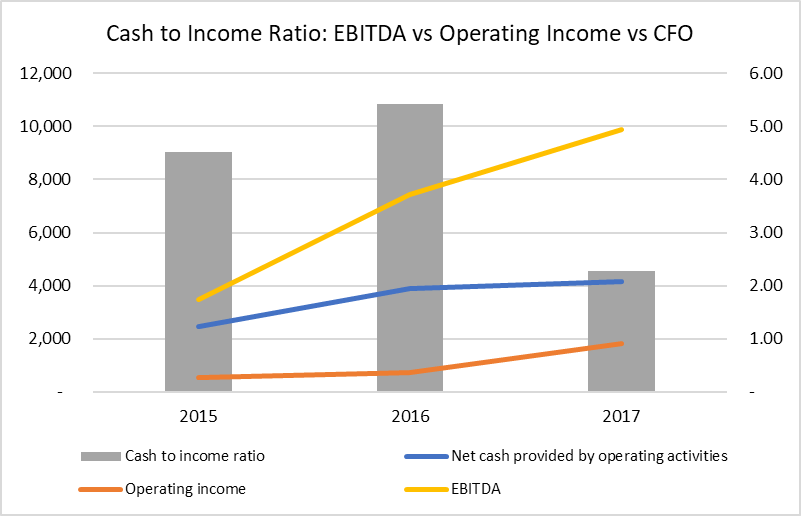

Cash To Income Ratio Formula And Example

Pdf Liquidity Analysis Using Cash Flow Ratios And Traditional Ratios The Telecommunications Sector In Australia Semantic Scholar

Cash Flow From Operations Ratio Formula Examples

Financial Analysis Cash Ratios And Activity Ratios

Pengertian Price To Cash Flow Ratio Harga Terhadap Arus Kas Dan Rumus P Cf Ratio

Change In Working Capital Video Tutorial W Excel Download

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Pre Operating Expenses Cash Flow Ppt Powerpoint Presentation Model Graphics Cpb Powerpoint Presentation Designs Slide Ppt Graphics Presentation Template Designs